Get the latest Insights and News from Oakhurst.

Articles

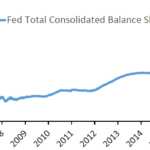

- “Jumbo Shrimp”Having closed out another very impressive year for risky assets, investors turn their attention to the upcoming quarters as they search for signs that will provide clarity and predictive powers. The unprecedented involvement of the Federal Reserve in our financial markets, though, has muddied the typical metrics in which many investors have historically found comfort. In the equity market, investors often focus on ratios such as price-to-earnings, price-to-book, and price-to-sales, while also employing models like the discounted cash flow approach. Interest rates have a meaningful influence on valuations of all assets, with the U.S. dollar rates always being the primary benchmark across global markets.

- Fixed Income Update & Strategy OutlooksHello, I’m Barry Julien, Chief Investment Officer at Oakhurst Capital Management. With a great deal of recent changes in the bond market, we thought it timely to provide a market update and mention some interesting opportunities that we are finding for our clients. This morning inflation surprised on the upside, with 0.6% readings for both core and headline CPI in January, bringing the year-over-year figure to 7.5% and 6%, respectively. These figures represent a 40 year high.

- “Trouble with the Curve”Having closed out another very impressive year for risky assets, investors turn their attention to the upcoming quarters as they search for signs that will provide clarity and predictive powers. The unprecedented involvement of the Federal Reserve in our financial markets, though, has muddied the typical metrics in which many investors have historically found comfort. In the equity market, investors often focus on ratios such as price-to-earnings, price-to-book, and price-to-sales, while also employing models like the discounted cash flow approach. Interest rates have a meaningful influence on valuations of all assets, with the U.S. dollar rates always being the primary benchmark across global markets.

- A Tale of Two Cities“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of light, it was the season of darkness, it was the spring of hope, it was the winter of despair.” One of the most famous openings of any novel, the Charles Dickens’ prose, though written in 1859, seems as fresh and poignant as ever. Longtime readers of this quarterly communique may recall the appropriation of this sentence many years ago, so please forgive the indulgence to employ it once again, as the parallels to the past year were too eerie to resist.

- Finding Mutual Funds That Beat The MarketCredit: Forbes Click here to view the article on Forbes How do you make an actively managed mutual fund do well, especially in these crazy times? For 2020, 60% of actively managed stock funds underperformed the S&P 500. The situation was worse with active bond funds, where 90% failed to clear their

- Boutiques Look for Third-Party Investors as Industry ConsolidatesCredit: Lisa Fu – Fund Fire Consolidation in the asset management industry has led some portfolio managers to question the future of their teams and enlist third-party support to leave parent companies. In November, three third-party assisted transactions were announced. Los Angeles-based RIA Lido Advisors partnered with F/m Acceleration to